do pastors pay taxes in canada

Since 1943 Murdock v. 105 the United States Supreme Court has ruled that the First Amendment guaranty of religious freedom is not violated by subjecting ministers to the federal income tax.

Second churches are not allowed to withhold SECA taxes for pastors.

. Calculation of Payroll Deductions The following example is for a pastor who is earning an annual salary of. While places of public worship are statutorily exempt other property owned by a religious organization may be subject to property taxes unless the organization is granted a permissive exemption. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax.

Do pastors pay taxes. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax. Much has been written about the clergy residence deduction CRD which is available to clergy and other eligible individuals in Canada.

Do pastors pay taxes. Pastors most certainly pay taxes on their income. On your T4 slip if you receive a housing allowance you can find your receipt.

Clergy residence - Canadaca Clergy residence Clergy residence deduction If your employee is a member of the clergy they may be able to claim a deduction from income for their residence when filing a personal income tax and benefits return. And in fact religious organisations do pay tax where appropriate. Such property might include parking lots playgrounds offices or even empty lots that the organization may develop in the future.

Churches Cannot Withhold SECA Taxes For Pastors. If that is the case the church should withhold income taxes only not Social Security taxes which you must pay quarterly throughout the year. The pastor will be able to claim the Clergy Housing Deduction as outlined in item 5 below e.

To be eligible an individual must meet both a status test and a function test. Do pastors pay taxes. It is important to remember that all ministers including those who are employees of a church must pay Social Security tax under SECA on income from ministerial services.

If requested by Canada Revenue Agency CRA. Depending on what sub-category they fall into they pay fringe benefits tax payroll tax land tax rates and other local government charges stamp duty and so on. The practice is not to treat such a gift as income for income tax purposes.

Does The Catholic Church Pay Income Tax. The median annual Pastor salary is 93154 as of October 30 2017 with a range usually between 76557-105579 however this can vary widely depending on a variety of factors. Hereof Which is the richest church in the world.

If you are employed as a member of the clergy a religious order or as a regular minister of a religious denomination you must report your employment income like any other taxpayer. Pastor provides hisher own accommodation the church offers just a gross salary and the pastor is responsible to determine the fair market rental value of their house or apartment and hence the amount that they will claim as Clergy Residence Deduction. If you receive a housing allowance it is considered to be a taxable benefit and will be shown on your T4 slip in Box 30.

Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax. If a church withholds SECA taxes it can mess up the pastors records with the Social Security Administration. The status test in the Christian Reformed Church CRC context is normally met where an individual is ordained for service.

The additional amount will. Do Priests Pay Taxes. Neither the pastor or the church has any say in the matter thats just the way it is.

Do Ministers Pay Income Tax In Canada. Cant speak for Canada but US. If the church owns and provides a home for the pastor and his family the rental value of the home will be added as a taxable benefit and included in his T4 return.

Attached as Exhibit A d. Clergy can request that an additional amount of income tax be withheld to cover their self- employment tax. In NSW they qualify for land tax concessions.

Ministers are not exempt from paying federal income taxes. By relying on their superiors they are able to earn a modest living allowance that is not tax deductible. Do pastors pay taxes.

Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax. Churches Can Withhold Income Taxes For. Clergy must pay quarterly estimated taxes or request that their employer voluntarily withhold income taxes.

Like any other taxpayer if you work for a religious order or parish member or serve as a regular minister in a religion or religious denomination you report your earnings when reporting them to the IRS. The church is not obligated to withhold income tax. Do church workers pay tax.

This amount is not included in the income or expense of the church and individual donors do not receive tax relief for such gifts. The average salary for a Pastor in Canada is C51344. It is a free country.

In spite of their vows of poverty priests nuns monks and brothers working for churches do not pay taxes. In Victoria they dont. Our team of Certified Compensation Professionals has analyzed survey data collected from thousands of HR departments at companies of all sizes and industries to.

Visit PayScale to research pastor salaries by city experience skill employer and more. Still ministers have tried to argue against this ruling for decades.

Why Do Canadian Universities Charge 4 Times The Normal Fees For International Students As Compared To Canadian Students Quora

Do Priests Pay Income Tax In Canada Ictsd Org

Called To Canada Non Canadian Pastors Serving Canadian Churches The Network

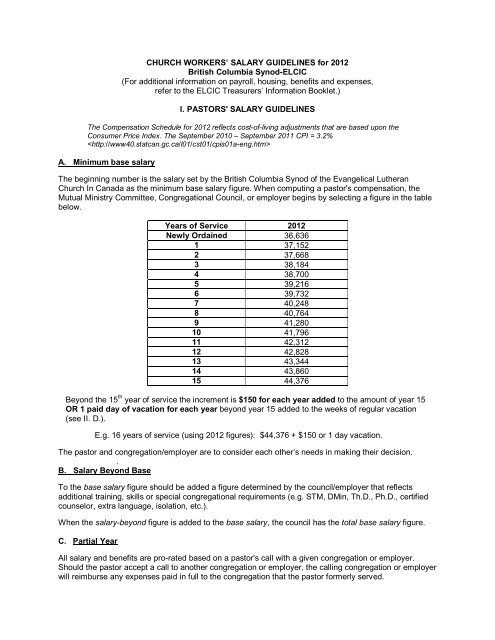

Church Workers Salary Guidelines For 2012 Bc Synod

Where Do Churches Get Their Money In Canada Cubetoronto Com

How Much Do Pastors Make In Alberta Cubetoronto Com

Why Do Canadian Universities Charge 4 Times The Normal Fees For International Students As Compared To Canadian Students Quora

Church Stewardship Church Ownership The Church Is Not Ours The Vision Of The Church Is Not Ours It Is God S As Leaders You Must Articulate The Vision Ppt Download

Do Pastors Pay Taxes In Canada Ictsd Org

Do Churches Pay Taxes In Canada

Do Priests Pay Income Tax In Canada Ictsd Org

Do Pastors Pay Taxes In Canada Ictsd Org

Do Priests Pay Income Tax In Canada Ictsd Org

Do Priests Pay Income Tax In Canada Ictsd Org

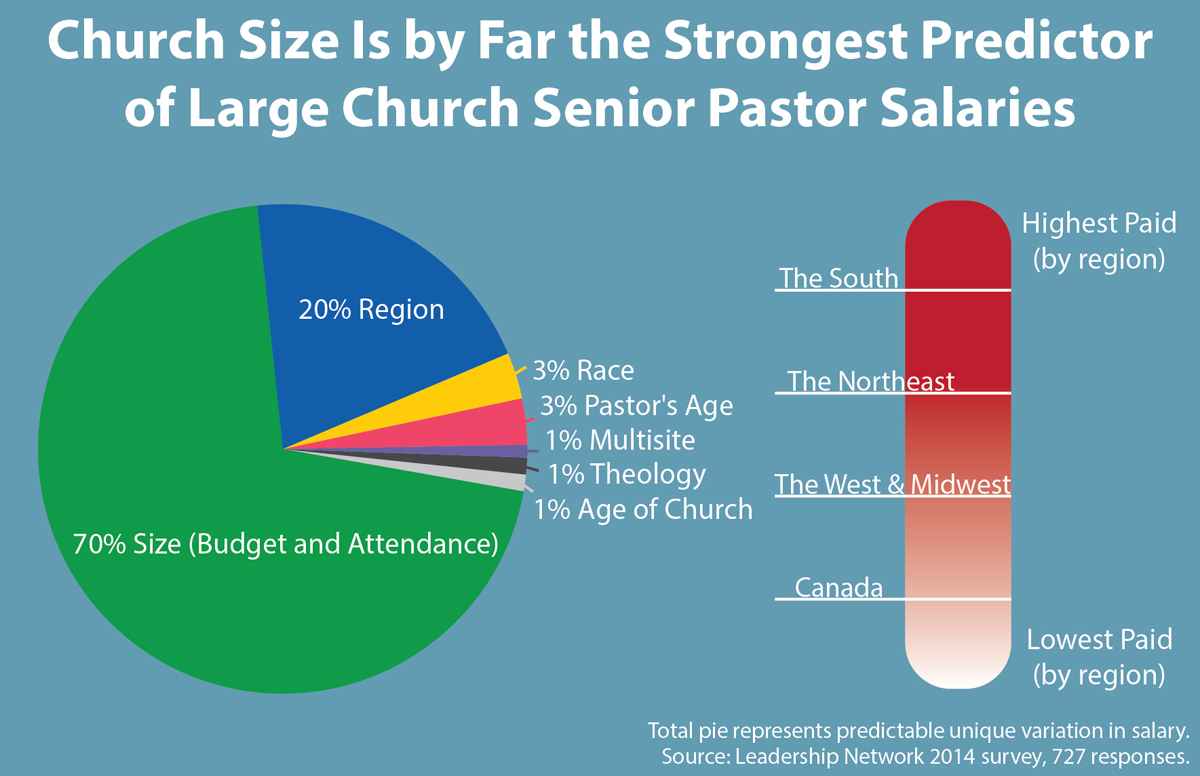

Big Churches Big Bucks Southern Senior Pastors Take Top Salaries